Adaptive reinvention in the real estate sector at the start of a new era

This article is based on the Chairperson’s Message at the PropertyGuru Asia Real Estate Summit originally presented on 8 December 2022.

We cannot rely on the past to foretell the future, and this is the case in any new era.

As a team at Asia Real Estate Summit (ARES), we conduct an in-depth retrospective of every event. It has now been over 12 months since ARES in December 2022, and our comprehensive review has thus far proven to be extremely rewarding. The theme of ARES 2022 was “Adaptive Reinvention.” As outlined below and throughout this white paper, this theme, along with insights from our ARES speakers and panellists, collectively addressed critical issues for both the sector and the region.

Adaptive. This term encompasses all activities in the real estate sector. Whether it’s greenfield developments, redevelopments, capital renewal programmes, or general operations, it is the incremental, step-by-step changes that are essential for achieving successful outcomes in the sector.

Reinvention. This refers to the responses required to the challenges we face. The dynamics of the world post-pandemic, along with the current financial landscape, forecasts, and various other significant factors outlined in this white paper, clearly show that we are navigating uncharted territory. This extends far beyond the typical and historical boom-peak-bust-trough cycles. It highlights the imperative for reinvention in all that we do.

The new era

We cannot rely on the past to foretell the future, and this is the case in any new era.

But is this really a new era? The answer is yes.

It can be said that we are in a new era due to the numerous unprecedented and uncharted financial, economic, and societal changes we have witnessed. Some of these are outlined below. However, before we explore these changes, let’s reflect on history for some food for thought. 100 years ago, the ‘Roaring 20’s’ were heralded as a ‘new era’. And indeed, it was.

The ‘Roaring 20’s’ was an era of sweeping economic, political, and social changes. There were many aspects to the economy of the 1920s that led to one of the most crucial causes of the Great Depression: the Stock Market Crash of 1929. This serves as historical context. While it is not assumed that history will necessarily repeat itself, the great optimism, advancements, and changes that were happening in the 1920s, closely intertwined with the subsequent Great Depression, warrant careful and strategic reflection.

A new era is not only a positive force; it is multidimensional. The thesis of this white paper introduction is that Asia will have the most positive outcomes in the present and for decades to come, with the real estate sector playing a pivotal role in achieving optimal overall outcomes. This underscores the importance and necessity of adaptive reinvention.

Global financial environment

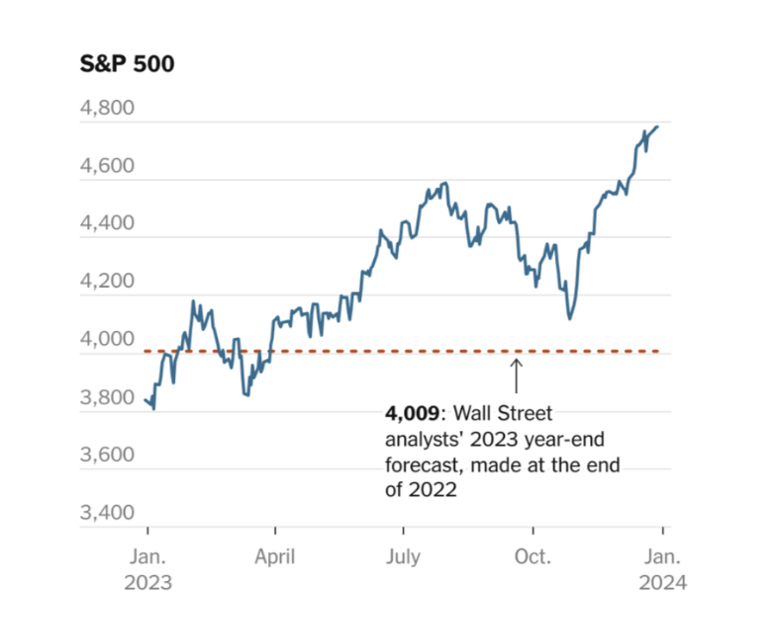

Financial forecasts post-Covid were positive. However, few foresaw the extraordinary growth experienced by leading businesses globally, exemplified by the remarkable performances of indices like the S&P 500.

As indicated below, the S&P 500 clearly reflects an unrelenting trend of strong growth throughout the entire 40-year period the S&P 500 is charted since 1984. This trend is reflected across all markets globally.

As outlined throughe the white paper, the combination of financial activity and population demographics positions Asia as the centre of the largest growth globally, now and for the foreseeable future.

The world post-Covid

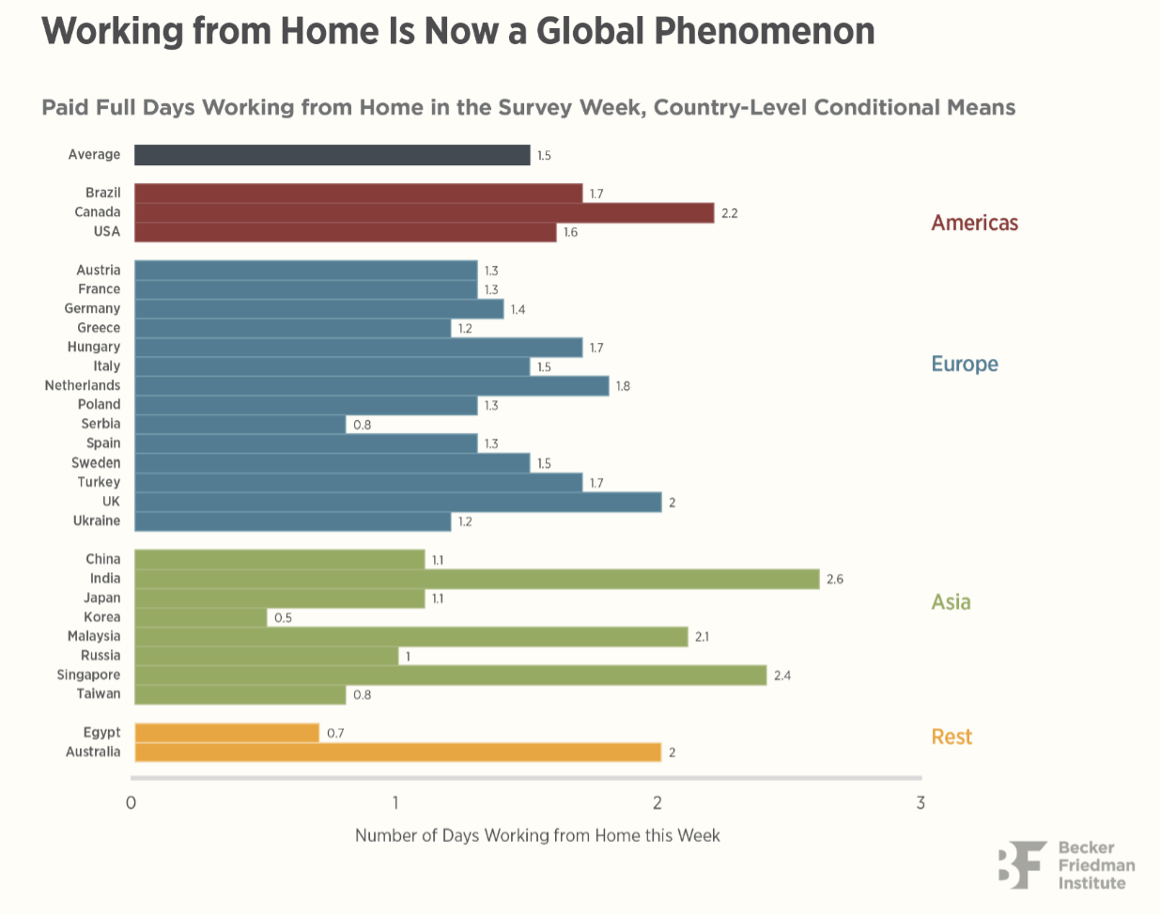

The extent of changes following the Covid pandemic is extraordinary, with every dynamic undergoing a transformation. The advent of working remotely has given a new dimension to globalisation.

For decades, urban migration to cities was the norm, but now, working from home is no longer taboo — it has become the new normal. This changes real estate demands in the cities, suburbs, and regions around cities, or places too far for daily commuting but close enough for occasional drives to cities. It effectively changes the requirements for real estate assets in all these locations. Furthermore, in cities, offices are no longer catering to a captive market where employees are obligated to come to work. City buildings must now attract people back to the office, affecting every class of real estate or asset.

Population growth and demographics

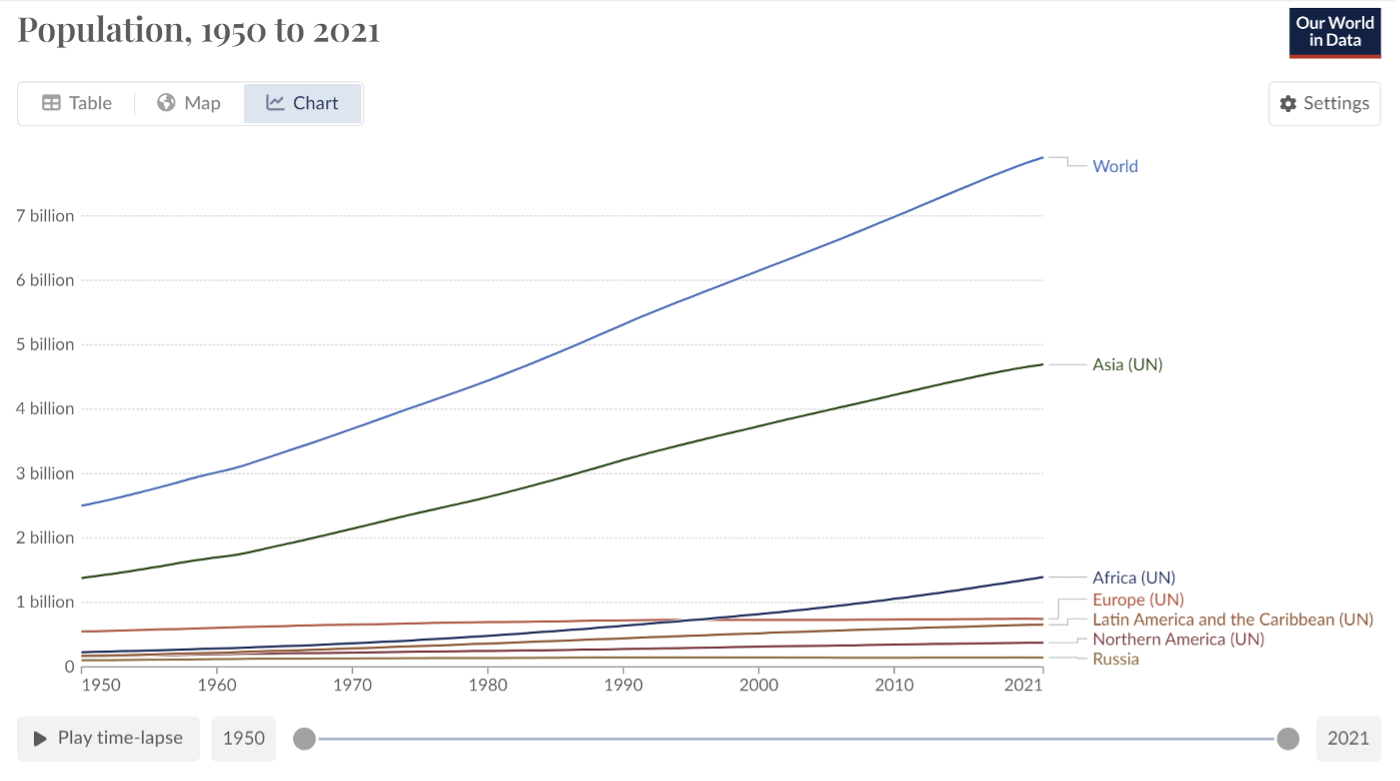

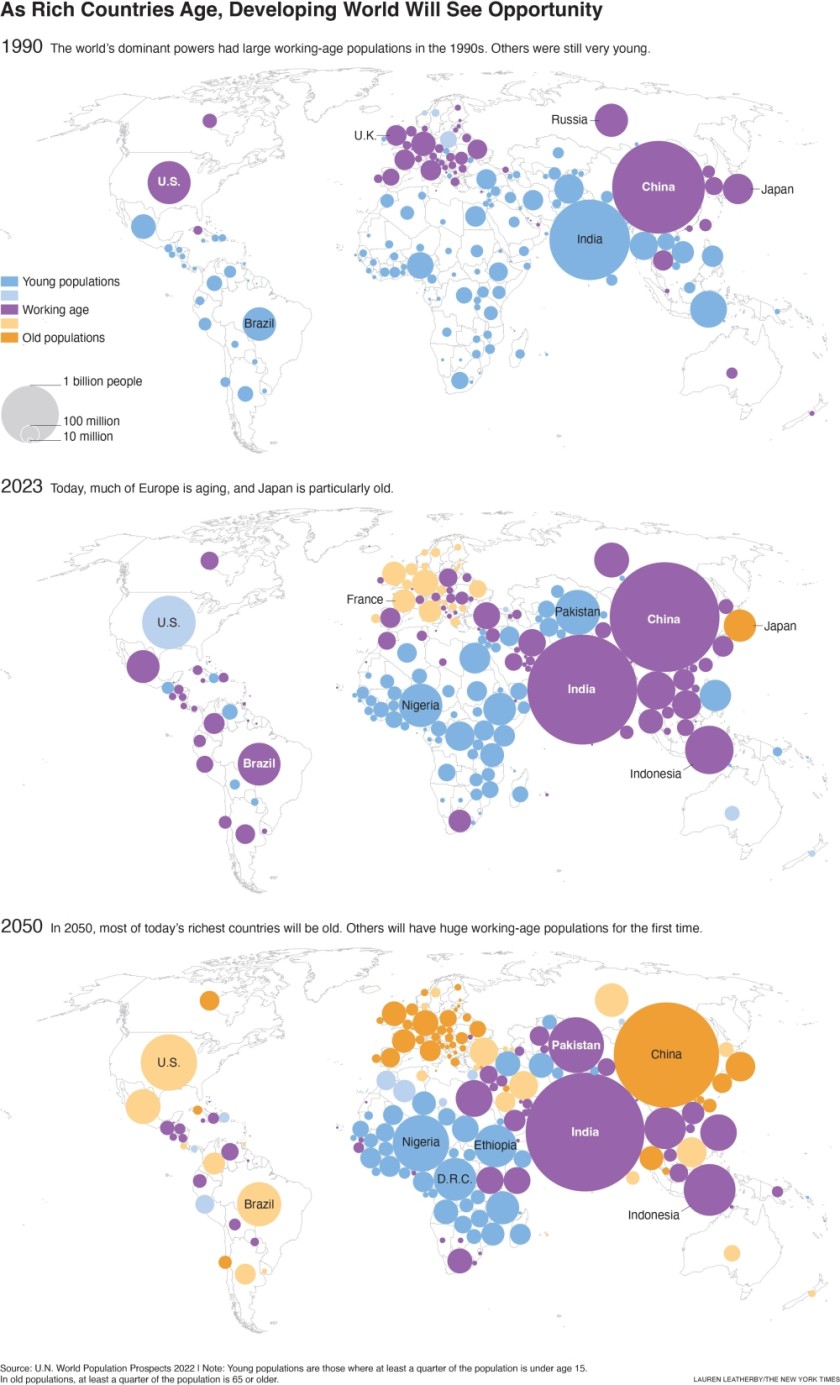

How significantly the world will be transformed by demographic changes in the next 10 years and beyond is astounding.

The most significant challenges and opportunities are in Asia, where the greatest shift in demographics is forecast to occur. These changes are not set to occur in the far-off future – they are happening now, and they are influencing every aspect of the real estate sector.

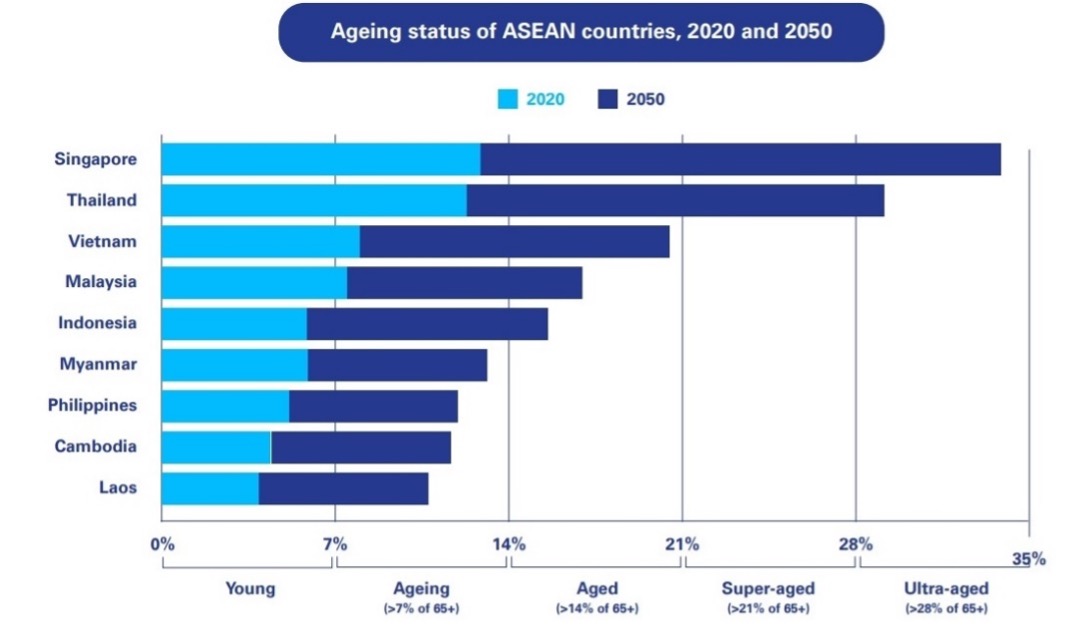

The significant change in demographics in Asia from 2020 to 2050 is forecast below, and the rate of change is unprecedented. This fundamentally affects all real estate assets, completely changing the nature of real estate asset demand.

As outlined below, the greatest demographic changes and opportunities are in Asia. This affects all real estate assets.

The Asia Pacific region and the real estate sector

The challenges for this new era are global, however, the majority of opportunities are in the Asia Pacific region.

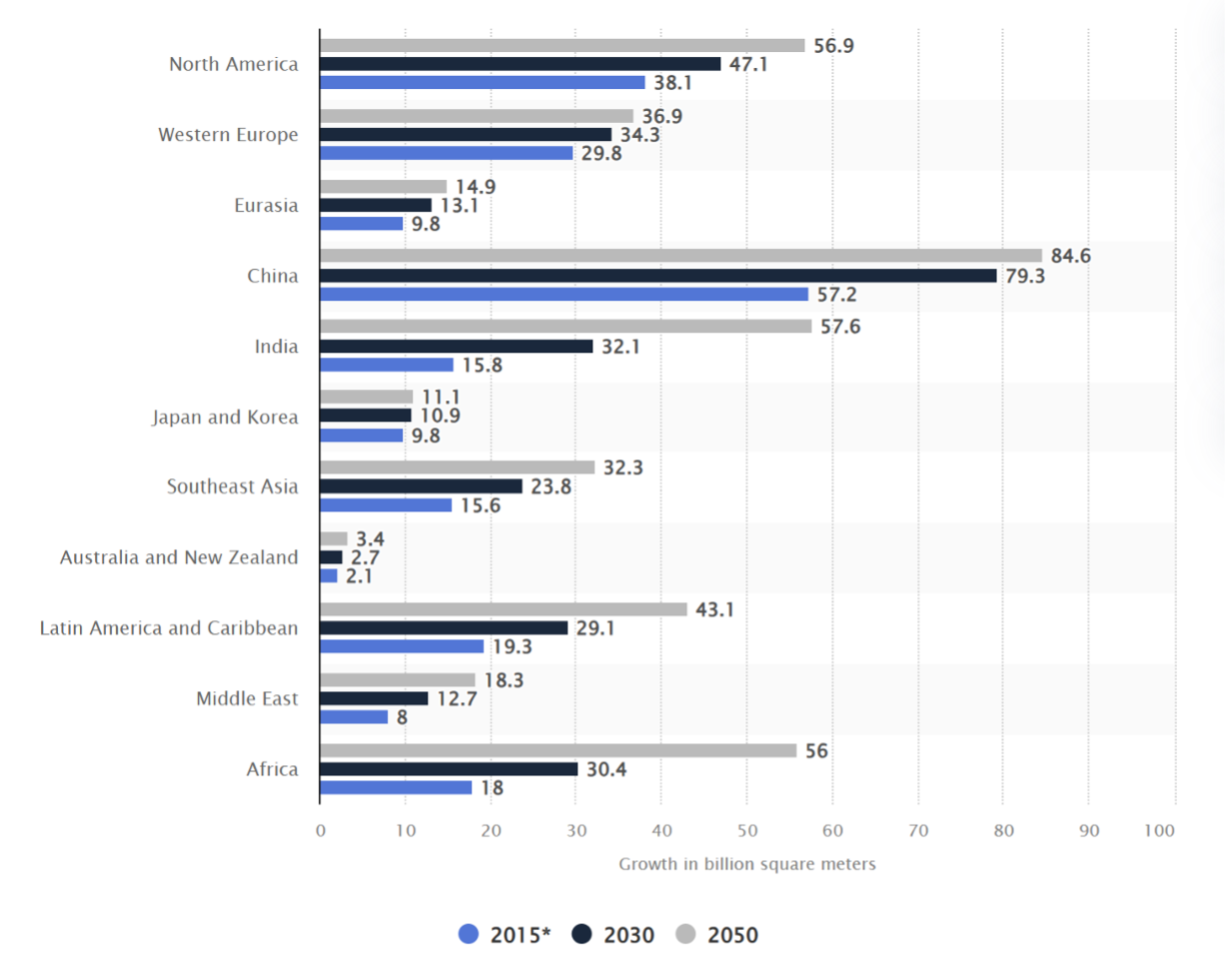

As indicated below, the overall expansion of building floor area, measured in billions of square metres, is occurring in our region. The levels of projected building area growth in the region for 2030 and 2050 are extraordinary.

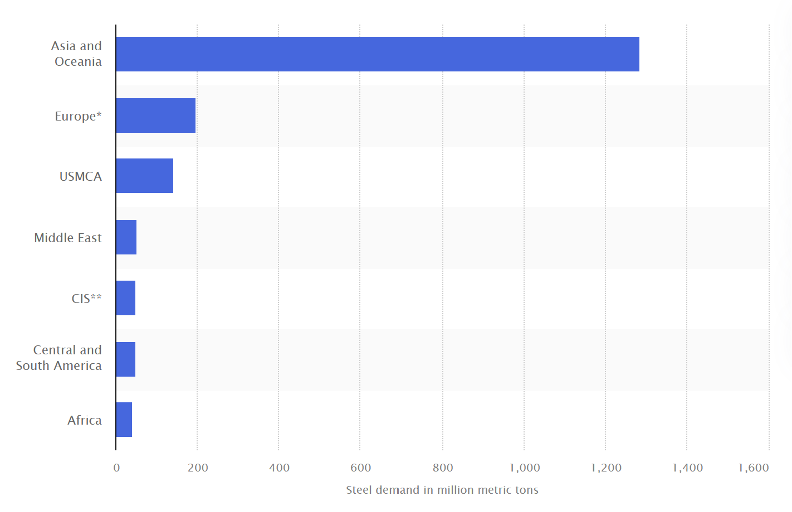

It is possible to review the above and not fully appreciate the dimensions across industries and communities. For example, consider the extent of growth in our region concerning the projected steel demand across global regions, as outlined by Statista in 2023 below. The comparative activity forecast levels in our region are extraordinary.

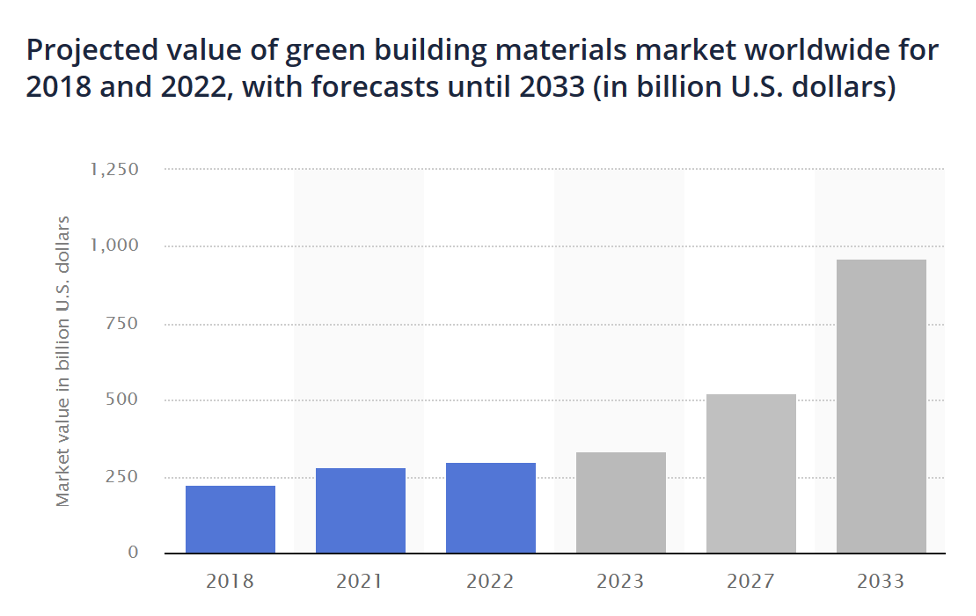

The growth in traditional products is just one of the unprecedented factors impacting the real estate sector and driving the need for adaptive reinvention. An illustrative example involves emerging new products and services, with our region as the epicentre. It is imperative that we align with the exponential demand and delivery growth of sustainable products and services in the real estate sector.

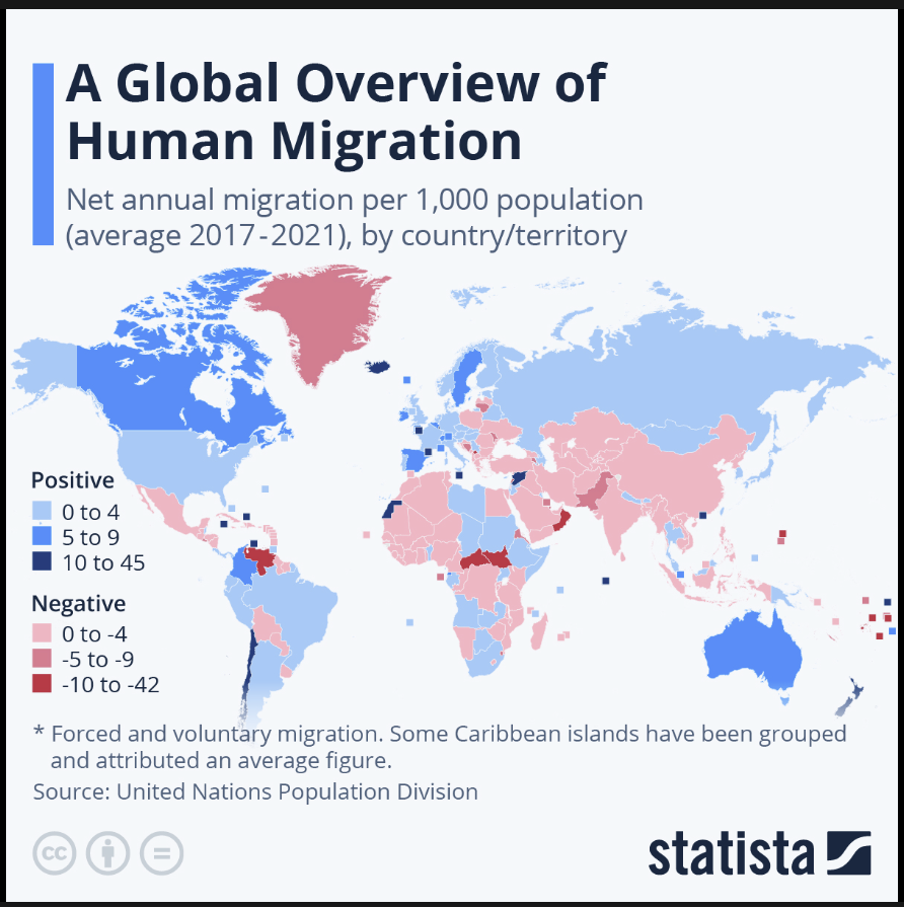

In terms of population growth and dynamics, Asia has the most significant net negative annual levels of human migration. This brain drain in the region is turning around — a necessary shift, particularly given the aging population dynamics. Furthermore, social sustainability is required through an improved balance of working–age individuals supporting their societies by contributing to productivity, GDP growth, taxation contributions, and social security frameworks. This turnaround in the region affects the demand for all real estate assets.

All the above points underline the compelling issues and exciting opportunities encompassed by the challenges of adaptive reinvention, including:

- Affordable Housing – the need for affordable housing strategies in every country is undeniable, with only the bespoke requirements, regulatory controls (including incentives), and delivery pathways varying.

- Sustainability Throughout Asia – the intrinsic link between economic development, infrastructure expansion, and financial markets all driving considerations and outcomes under all four sustainability pillars: environmental, human, social, and financial.

- Real Estate Sector Responses – under all four sustainability pillars and the region’s economic and demographic parameters, for example, the reorientation of design, materials, and the experience of tiny homes, among other aspects, all confirm that progress is not only about doing things better but also about doing things differently, such as through enhanced vision, strategies, and processes.

- Social and Human Evolution – society has historically been classified and united in large groups. Minorities were often regarded on an ‘us-and-them’ basis. This is changing, with minorities increasingly being recognised inclusively, and there is greater acceptance of individual expressions and freedoms, signifying substantial, albeit slow, progress. This transformation is impacting all aspects of how we live and work, consequently influencing every facet of the built environment.

In the white paper, we are joined by experts and industry professionals who explore the challenges and opportunities of adaptive reinvention in the Asia real estate sector

This article was originally published on ARES White Paper Volume 3. For more information, visit AsiaRealEstateSummit.com or email [email protected].

Recommended

How LIMA Estate in the Philippines is reshaping green business hubs

LIMA Estate models a citywide vision that uplifts workers while appealing to climate-conscious employers

ARES White Paper Volume 3: The era of adaptive reinvention

Pioneering sustainable and innovative practices in urban development

ARES White Paper Volume 2: Unravelling the power of data revolution in real estate

Insights on proptech, smart cities, and sustainable development

ARES Digital White Paper Volume 1: The fundamentals of responsible building

Green and climate heroes join forces to discuss how Asia Pacific can weather the current environmental crises and the looming effects of climate change